28+ How much mortgage do you get

Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

S2u2zu2f0adglm

Cap the loan-to-income ratio for the majority 85 of their lending at no more than four and a half times your income.

. Were Americas 1 Online Lender. Compare Quotes See What You Could Save. Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements.

How much income do you need for a 300 000 mortgage. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Find Mortgage Lenders Suitable for Your Budget.

Its A Match Made In Heaven. Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. For example with a 4500 monthly income you should spend no more than 1260 on.

One way to decide how much of your income should go toward your mortgage is to use the 2836 rule. Get Instantly Matched with Your Ideal Home Loan Lender. Take Advantage And Lock In A Great Rate.

To purchase a 300K house you may need to make between 50000 and 74500 a year. Save Real Money Today. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating.

For example if your combined household income is 50000 a mortgage. Using our Mortgage Balance Calculator is really simple and will immediately show you the remaining balance on any repayment mortgage details you enter. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

If the home purchase price is between 500000 and 99999999 you must have at least 5 for the first 500000 and 10 for the remaining amount. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Once you get your loan approved its time to attend a closing meeting.

New no-down payment mortgage. This is a rule of thumb and the. Get Offers From Top Lenders Now.

Medium Credit the lesser of. According to this rule your. Ad Work with One of Our Specialists to Save You More Money Today.

Ad 10 Best Home Loans of 2022 Top Lenders Comparison. Receive Your Rates Fees And Monthly Payments. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

The maximum amount you can borrow with an FHA-insured. You may qualify for a. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193.

Bank of America s new Community Affordable Loan Solution requires no down payment requirement no closing costs no minimum credit. As part of an. Most home loans require a down payment of at least 3.

Compare Now Skip The Bank Save. You can plug these numbers plus. The amount of money you spend upfront to purchase a home.

Get Started Now With Quicken Loans. Ad Whether Youre Buying Or Building A Home Well Help Guide You Through The Entire Process. But ultimately its down to the individual lender to decide.

A Critical Number For Homebuyers. Its A Match Made In Heaven. Were not including additional liabilities in estimating the income.

Were Americas 1 Online Lender. Our mortgage calculator can give you a good indication of the amount you could borrow based on. To determine how much you can afford using this rule multiply your monthly gross income by 28.

For home prices 1. Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you should not. For example if you make 10000 every month multiply 10000 by.

Ad Compare Mortgage Options Get Quotes. Looking For A Mortgage. To calculate this multiply your monthly income by 28 or 36 and then divide it by 100.

Get Started Now With Quicken Loans. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Looking For A Mortgage.

A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. To afford a mortgage loan worth 360k you would typically need to make an annual income of about 100k and be able to afford monthly payments worth 2000 and upwards. Ad Compare Mortgage Options Get Quotes.

Choose Smart Get a Home Loan Today. A 20 down payment is ideal to lower your monthly payment avoid. Total Monthly Mortgage Payment.

If you have excellent credit with a 20 down payment a conventional loan may be a great option as it usually offers lower interest rates without private mortgage insurance PMI. Lender Mortgage Rates Have Been At Historic Lows.

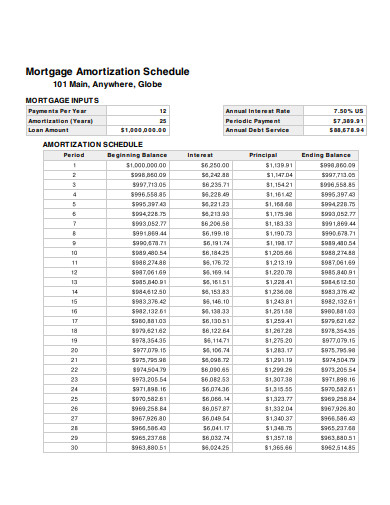

Tables To Calculate Loan Amortization Schedule Free Business Templates

Pin By Vicki Betancourt On Things I Ve Made Girls Bathroom Diy And Crafts Kids Room

House Design Saved By Sriram House Exterior Small House Elevation Design House Outer Design

Kpvxocrkdy Xnm

Krtbo5h1qikr4m

Cost Tracker Templates 15 Free Ms Docs Xlsx Pdf Downloadable Resume Template Templates Excel Spreadsheets Templates

14 Best Ways To Save For A House Hanfincal Com

Macro Shot Of Increase In Mortgage Rate Concept Free Image By Rawpixel Com

Hardship Letter Template 28 Lettering Letter Templates Business Letter Template

Kitchens Ron Davis Custom Homes Kitchen Remodel Kitchen Custom Homes

Total Debt Service Ratio Explanation And Examples With Excel Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

3uruzsxkc0lpjm

Ou Krrxtlq6nvm

Sample Letter Of Explanation For Mortgage Refinance Luxury Cash Out Letter Template Konusu Lettering Letter Templates Business Letter Template

Second Story Addition Floor Plans Ranch Home Addition Plans Floor Plans

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates